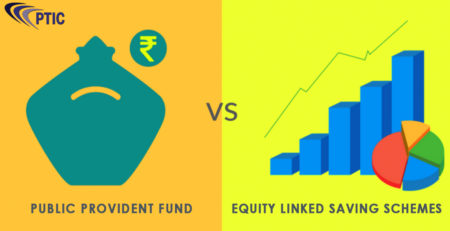

5 THINGS TO BE AWARE OF BEFORE INVESTING IN ELSS

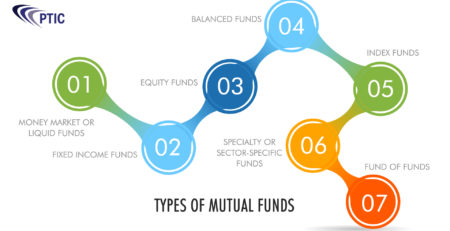

ELSS is an equity mutual fund which invests most of your money in the stocks across various sectors. ELSS helps in growing your wealth and also saving you from tax payments. It is considered to be the fastest way to grow rich.

It is essential that you choose the right ELSS scheme make sure that you choose the one with a 5-star rating and learn about its terms and conditions well in advance. A good ELSS could provide you with 11-14% returns over 3 years which is more than a 5-year plan.

Just keep the following 5 things before starting to invest in the ELSS funds.

-

ELSS HAS HIGH EQUITY EXPOSURE

ELSS is a small and a perfect step towards starting to invest in the equity shares. This gives you a gradual welcome to the world of equity rather than directly jumping in the stock market and buying shares. You can invest a minimum of Rs.500 in the ELSS. This way you don’t need to time the market you can just open time in the market.

If you feel that you have excess money then try to put it in ELSS for the most beneficial comebacks.

-

ELSS IS A TAX SAVER

The best part about investing in an ELSS is that it helps you in saving your taxes. The returns are tax-free but however, long term gains may be charged with a 10% tax for the gains over Rs. 1 lakh per year. ELSS is a house to the mutual fund distributors, not any commissions are paid to them. ELSS is known to save up to 46,800 a year in taxes.

If you are finding the whole concept about the ELSS difficult to understand don’t worry. We at PTIC will explain the basics of ELSS to you and help you make a better investment in them.

-

ELSS COMES WITH A 3 YEAR LOCKED UP PERIOD

Once you have invested in ELSS that means that you have locked your funds in this for up to a time period of 3 Years. Which means that you cannot withdraw any money for that time period. So be aware before you plan on investing in these are your money will be totally locked up for the next three years. Chose this option only if you are comfortable with the consequences.

Equity investments are mainly for the long run. Once you have your money in them its safe for up to 3-5 years and this ensures that you are likely to enjoy the benefit of high returns.

-

ELSS OFFERS BOTH GROWTH AND DIVIDEND OPTION

ELSS helps you in both growth and the dividend option this means that if you keep reinvesting your dividends in the ELSS then you enjoy the benefits for a longer period of time. It is always recommended for young investors to let their ELSS grow and not take the benefit of dividends immediately. However, the dividends can be beneficial for the people of retirement age as they will need a daily source of income.

-

RISKS INVOLVED IN ELSS

ELSS not just provides you with high return charges but it can also involve a high risk in ELSS. Especially for the newbies who are new to this equity market

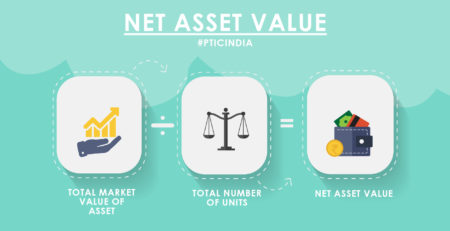

because they are not fully aware of the policy and simply invest without knowing the full knowledge. So be aware with high return there can even be high risks as there are a lot of fluctuations in the net asset values and other things that hamper the returns.

Know more about ELSS before investing in them get a full closure at your nearest PTIC branch and know your investments well. Compare and then choose the most suitable option for your investment from the variety of policies that the PTIC will tell you about. Be smart and be wise to visit PTIC for full information before making a decision.