6 Reasons why you should invest in Mutual Funds

Are you still confused about whether or not you should opt for a Mutual fund investment online ? Following are a few reasons which will help you make a decision. There is a routine that we live by and the routine involves earning, saving and then spending. And there is no doubt that saving is an important part of the cycle which in turn makes the investment all the more important. Investment basically leads to the multiplication of your money. And the rate at which your money multiplies definitely depends on your choice of investment. There are various things you could use your money. But the answer to why you should use mutual funds is given below.

Higher returns

One of the ultimate goals of investment is higher investments. Mutual fund online investment help you achieve that better than other investment options. Debt funds have consistently beaten Fixed Deposit (FD) returns and they also prove to be a good option for investors with low-risk intake. For investors with higher risk intake, equities prove to be a good investment opportunity.

Disciplined investing

You know how they say, inculcate good habits. And what is better than investing for your safe and secure future? When you begin a SIP (Systematic Investment Plan) you promise to invest a certain amount of money on the same day for a period of few months/years altogether. Such an activity helps you take constructive action towards your safe future. It becomes a part of your money cycle every month just like other components and all other expenditures cater to this. After your expenditure and investment are done, you will have your disposal income of the month. This leads you a step closer to your goal without any distraction on the way.

Professionally managed

Mutual funds investment are not handled by amateurs but by well-educated professionals. Their job is to keep an eye on the market and manage investments. It is the job of the fund managers to stalk the stocks on the rise, identify a good time frame to buy them and when to escape out by selling them. They spend time analyzing and comparing the performances of various players in the market. Also, all the mutual funds are governed by SEBI, making everything safe and transparent. So basically investing your hard-earned income and making sure you get high returns on it is his/her job. So don’t worry once you have identified and invested in the right mutual fund, it is the job of the fund manager to manage it.

Less/ No lock-in

As you are already aware that all the conventional investments come with long lock-in duration that makes it difficult for you to take your money out, in case of emergencies. Mutual funds online investment have low or no lock-in period. On top of it, you have the full flexibility to pull out your money whenever you want to. Mutual funds, those cater to your tax saving needs come in with a short lock-in period of 3 years. So your problem being stuck is definitely solved with mutual funds. Although it is recommended that you don’t pull out your money till the time of your goal for better and higher returns.

The fund which is made just for you

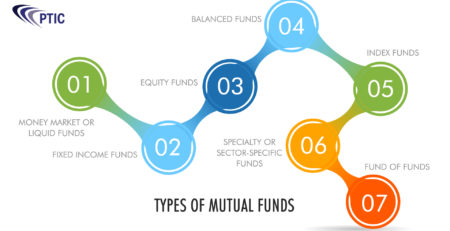

Firstly, there are a lot of options for you out there ranging from equity funds, debt funds to tax-saving funds, etc. So depending upon your requirement you can go ahead and choose whichever fund suits you. Secondly, you have the flexibility to select the time frame of your investment, the amount that you would like to invest and various other things. It is like the fund was made just for you, catering to all your needs and desires.

Convenience

Do you how convenient a mutual fund is these days? It is just a piece of cake. The whole thing is made accessible to you online by many companies out there. It will take you just a few clicks to start a SIP or make an investment. What more, you can track the performances online. Having said that, you can have an auto pilot mode. In this, you can set up a bank mandate per month and set your SIP on autopilot mode saving you from the trouble of manually investing every month. The SIP amount gets automatically debited from your account every month. Basically, the mutual funds investment made it super simple for you to invest with least efforts and potential for more returns.

So, right there are six reasons as to why you should opt for mutual funds. Did you know that the 7th of every month has been declared Mutual Fund Day? So what are you waiting for? Go and start investing in mutual funds. I know all this is too much to take but don’t worry there are always people to help and guide you through this. And on top of this, we are there to help you, all you need to do is make an account here and start your mutual fund investment journey right away. We will help you design a portfolio and much more.

Start investing in mutual funds with PTIC!