The idea of retirement has changed drastically over a period of 50 years and there has been a lot of advancement ever since. It is more likely to be seen that we are living longer and retiring early. Over the years, it is seen that few of us receive pensions and we are progressively responsible for our own incomes during the retirement phase that may have a short life of 30 years or so.

The questions that ponder upon us while we approach our retirement phase of life usually comes down to how we are going to support ourselves, how will you know what you’ll need to live on? How should we know which option to choose? How do we go about Health Care or when is the right time to collect Social Security?

There are few ways jotted down below to help you plan smartly for your retirement

1. Lay out your retirement goals.

2. Evaluate your current financial position.

3. Identify retirement income sources.

4. Assess your retirement risks.

5. Recognize your health care issues.

6. Invest your retirement holdings.

7. Organize your retirement income.

8. Monitor your retirement assets.

The following are some in-depth idea for each step:

Layout your retirement goals.

The very first step to go about this is by registering thirty retirement goals on a sheet. We recommend thirty since the first ten are easy to go about, the upcoming ten gets a little tougher to figure out and the next ten is usually what you really want to have in your goal list. The better way to do is to compute your goals as short, medium and long term goals and then assign a value to each wherever suitable.

Evaluate your current financial position.

To reach your retirement goals it is very crucial to take stock of where you stand today. A net worth statement will assess all of your assets and from which the retirement income may be computed. This will eventually lead us to assess budget needs during the retirement phase. Basically finding the answers to few questions like how to spend with the type of lifestyle you lead and also helps in figuring that you may need at least 80-90 percent of your pre-retirement income to successfully meet the retirement goals. It is better to prepare a retirement cash flow statement beforehand for the better and smooth functioning of that phase.

Identify retirement income sources

The retirement income can be acquired from various sources and the percentage of each may change over the period of time. The sources may include a pension, social security, IRA, accounts and other savings, and even part-time works. The after-tax benefits of these sources should be kept in mind. In fact, you should always determine the time of usage of these incomes.

Assess your retirement risks

One of the crucial points to be considered is the risks that may affect your retirement income. The situation like inflation dissolves the purchasing power of your income over the period of time. The various investment markets may grow to falter too.

Recognize your health care issues.

Usually, retirement brings about a change in health care insurance coverage schemes. For example, if you retire before the age of 65, health care insurance is your own responsibility but post 65 years old retire is given Medicare facility, though you can look into the Medicare gap to enfold the fees between your doctor’s fees and what Medicare usually pays.

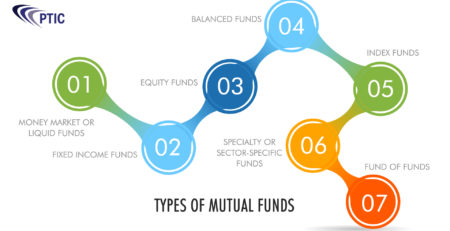

Invest in your retirement holdings

This investment policy statement acts as a road map for your retirement investments. An asset allocation (the compilation of stock, bonds, cash in your portfolio) should be clearly stated. The policy should also give an idea about the diversity of the investments made, whether it is appropriate for your goal and time frame, and is line with your risk tolerance. If the cases are in the favor, then the specified mutual funds, bonds or exchange-traded funds can be chosen and bought to reflect your investment policy decisions.

There are varying characters of the assets that need to be carefully evaluated. Some income such as wages and interests may be taxed at an ordinary tax rate whereas a few income sources like, dividend income and long-term capital gains may be taxed at a minimized tax rate. Hence it is crucial to take into account the tax consequences of asset purchases and sales.

Organize your retirement income

In the working world, our paychecks are usually acquired from the employer or the business, but as the retirement approaches, the paycheck concludes. Now the situation comes down to the fact that the source of income is varying. Proper managing of the income becomes the utmost important task which requires planning and monitoring. The size of the social security payments is dependent on the benefits you’re collecting. The longer the duration of the standby, the greater the monthly payment. Determination of the optimum time to commence on the social security payments is based on specific circumstances.

At the age of about 70 years, the IRS rules require that certain amounts be withdrawn from your IRAs. Required minimum distributions (RMD) are based on various factors inclusive of your age and the balance in your portfolio at the prior year-end. Failure to withdraw the minimum amount can lead to a 50 percent tax penalty on the amount that was not withdrawn on the time specified.

Monitor your retirement assets

It is important to supervise periodic reviews of your financial statement. With the help of the net worth statement and budget, a portfolio withdrawal rate may be computed. By governing the portfolio withdrawal rate, you can be confident that you will have sufficient assets to fully fund with retirement. In the worst possible scenario, part-time jobs may be beneficial but bottom line, you need to maintain and sustain a withdrawal rate strategy.

A quarterly review of performance is essential to identify and early signs of inappropriate asset allocation. This will also prove to be beneficial to give you the confidence to live the retirement lifestyle that you plan to lead.