26Aug

24Aug

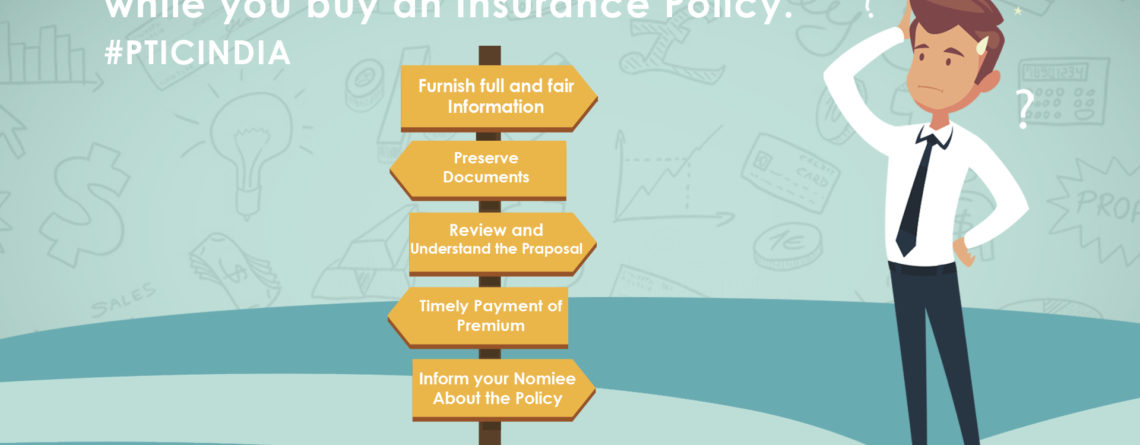

Know your duties as a policyholder, while you buy an Insurance Policy

An insurance cover is often not as simple as it sounds. With the growth of the internet, there is a variety of insurance coverage available to compare in the market. They offer different types of offers and discounts. And because of these lucrative offers sometimes...

22Aug

NAV work as a performance indicator for your Mutual Fund Investment

When purchasing a commodity, we all ask for two simple things to decide the worthiness of the money we pay in for our investments. And that is product quotation and performance. Mutual funds are no different. Mutual funds in a layman’s language are organized and...

21Aug

Mutual Fund investment planning through your post retirement income

In India, old age, retirement, and pension are terms that are used almost interchangeably. Hence, it should not come as a surprise that for retirement planning, the conveniently named pension plans offered by insurance companies are hot favorites. In fact, most...

19Aug

7 Reasons ELSS are Better Than Other Tax Saving Investments

The introduction or rather reintroduction of long-term capital gains taxes on equity mutual funds including ELSS(equity-linked savings schemes) has made some novice investors a bit jittery. A lot has already been written and said about long-term equity gains taxes on equity schemes....

14Aug

6 steps towards your financial freedom

Our 72nd Independence Day is now behind us! It has been nearly three-quarters of a century since our country has been free from the British Empire. We are free to live our lives the way we want to, within the confines of legal jurisdictions, of...

14Aug

This Independence Day take a step towards your financial freedom

For parents, there was a time when grown-ups and working sons were synonymous with both financial freedom and security. But with changing times and new social structures, that concept of financial security has become almost non-existent, at least in most of urban India. Other than raising...

10Aug

How you can stop your investment from slipping into insurance unclaimed funds

Recently, PTI reported that as much as Rs 15,167 crore of policyholders' money was lying unclaimed with 23 life insurers as on March 31, 2018. Out of this, Life Insurance Corporation (LIC) has Rs 10,509 crore as...

09Aug

Fixed deposit interest rates hiked but debt mutual funds still better

Interest rates are on the rise. SBI and HDFC Bank have hiked interest rates for fixed deposits below Rs 1 crore. HDFC Bank is offering 7% for deposits below Rs 1 crore for tenures from 1 year...

07Aug