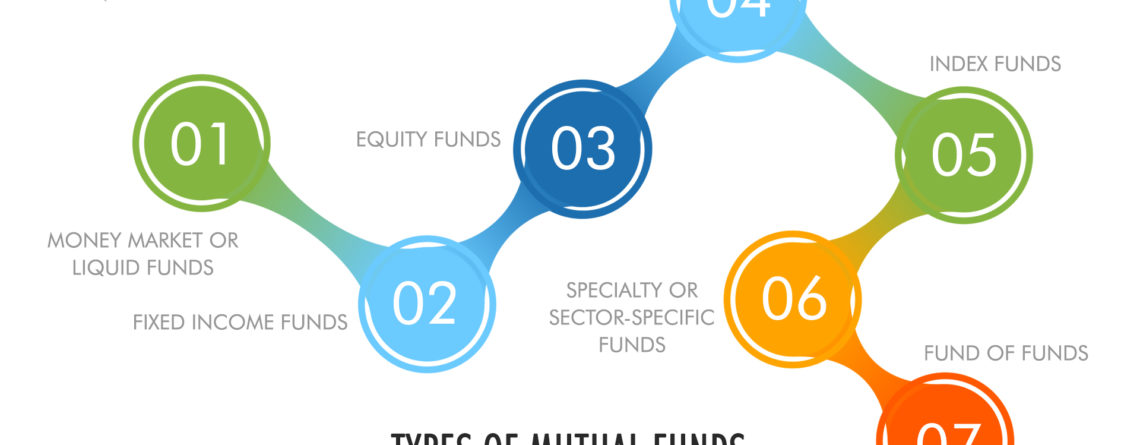

Are you a first-time investor or looking for an investment in Mutual Funds? In Mutual Funds investment, you need to understand the different types and features of Mutual Funds. MF can be classified on the basis of their characteristics. Here is a list of different type of Mutual Funds in India:

1. Money Market or Liquid Funds:

Money Market Funds are a safer investment option for short-term. These funds give you easy liquidity and moderate return in a short period of time (91 days or less). Money Market Funds also known as Liquid funds. Through these funds, you can invest in securities such as Bonds, Treasury Bills, Commercial Paper, and Certificates of Deposit. These type of funds are suitable for individual or corporate investors.

2. Fixed Income Funds:

As the name suggests, these funds give you a fixed rate of return with a stable income. Through these funds, you can invest in Government Securities, High-yield Corporate Bonds, investment-grade corporate bonds. These funds provide you with low risk and produce regular income. These funds are suitable for low-risk investors.

3. Equity Funds:

Equity Funds mainly invest in stocks. Their main objective is to provide long-term capital growth with higher risk. Through these funds, you can grow money faster than Money Market and Fixed Income Funds. There are different types of Equity Funds in the market such as large-cap, mid-cap, small-cap stocks. These type of funds are suitable for long-term & high-risk appetite investors.

4. Balanced Funds:

Balanced Fund is a combination of stocks and bonds. These funds invest in a mix of Equity and Fixed Income instruments. The main objective of these Funds is to make balance in providing higher returns against the risk of losing money. These funds are suitable for those investors who are looking for a combination of income and moderate growth.

These funds aim to track the performance of a specific index such as the S&P CNX Nifty & BSE Sensex. As the index goes up and down, the value of the mutual fund will go up or down. Index funds typically have lower costs than other managed mutual funds. And investment in these funds easy to understand for investors.

6. Specialty or Sector-Specific Funds

These funds invest in particular sectors and industries such as Pharma, IT, Real Estate, and commodities. Sector-specific funds are less diversified and riskier than other managed MF. Because their performance is dependant on a particular sector or industry. These type of funds high suitable for aggressive investors.

7. Fund of Funds:

Fund of funds is a mutual fund schemes through which we invest in other Mutual Fund schemes. These funds offer an opportunity to diversify risk by spreading investments across assets. These funds are suitable for small and low-risk investors.

Before you invest, understand your investment objectives and your risk appetite. If you invest in one MF Scheme, by default the risk factor becomes higher. And if you diversify your investment, then you end up stabilizing the risk involved. Learn more about Mutual Funds and how they work. You may also take help of our Mutual Fund Advisors to choose best funds that meet your needs.