Expert Investment Tips for Mutual Fund Beginners

Investing in mutual funds can be a great way to grow your wealth, especially if you’re just starting your investment journey. For beginners, understanding the basics and making informed decisions is crucial. At PTIC India, we provide expert guidance to help you navigate the world of mutual funds confidently. Here are some valuable tips for beginners looking to invest in mutual funds.

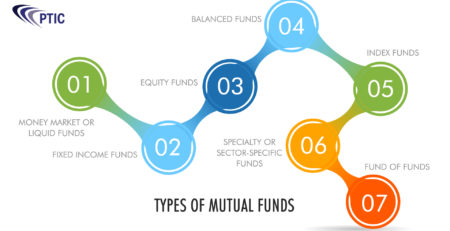

1. Understand the Types of Mutual Funds

Equity funds invest in stocks and are ideal for long-term growth. Debt funds focus on fixed-income securities like bonds and are suitable for conservative investors seeking stable returns. Hybrid funds combine both equity and debt for a balanced approach. As a beginner, it’s important to choose a fund that aligns with your financial objectives and risk tolerance.

2. Set Clear Financial Goals

Before investing, it’s essential to define your financial goals. Whether you’re saving for retirement, buying a house, or building an emergency fund, your investment strategy should reflect your objectives. Short-term goals may require safer, less volatile investments, while long-term goals can allow for more aggressive growth through equity mutual funds.

3. Start with SIP (Systematic Investment Plan)

A great way for beginners to start investing is through a Systematic Investment Plan (SIP). SIP allows you to invest a fixed amount at regular intervals, typically monthly. This method encourages disciplined investing and takes advantage of rupee cost averaging, which minimizes the impact of market volatility. SIPs also make it easier to invest in mutual funds without needing a large lump sum.

4. Diversify Your Investments

Diversification is key to managing risk in mutual fund investments. By spreading your investments across different asset classes and sectors, you reduce the impact of any single underperforming investment. Consider investing in a mix of equity, debt, and hybrid funds to create a well-balanced portfolio. This approach can help you achieve stable returns even in fluctuating market conditions.

5. Keep an Eye on Fund Performance

While it’s important not to react to short-term market movements, regularly reviewing the performance of your mutual fund investments is essential. Compare your fund’s returns against its benchmark and peers. If the fund consistently underperforms, you might want to reconsider your investment strategy. However, keep in mind that mutual funds are long-term investments, and patience often pays off.

6. Be Aware of the Costs

The expense ratio is the annual fee charged by the fund for managing your investments, while an exit load is charged if you redeem your investment before a specified period. Lower costs can lead to higher net returns, so it’s wise to opt for funds with reasonable expense ratios, especially for long-term investments.

Consult an Expert

Navigating the world of mutual funds can be overwhelming for beginners, but you don’t have to do it alone. Consulting an expert, like our advisors at PTIC India, can help you make informed decisions based on your financial goals, risk tolerance, and investment horizon. We provide personalized guidance to help you choose the right mutual funds and create a solid investment strategy.

Conclusion

Starting your investment journey in mutual funds doesn’t have to be complicated. With the right knowledge, a disciplined approach, and expert guidance, you can achieve your financial goals while minimizing risks. At PTIC India, we’re here to help you every step of the way, ensuring that your investments align with your future aspirations.

For more information on mutual funds and investment advice, visit https://www.pticindia.com or contact us at +91 9709107555.