When purchasing a commodity, we all ask for two simple things to decide the worthiness of the money we pay in for our investments. And that is product quotation and performance. Mutual funds are no different. Mutual funds in a layman’s language are organized and regulated by SEBI under SEBI (Mutual Funds) Regulations, 1996. Wherein a group of people collectively invest their money in securities. Mutual Funds allow its investors a diversified investment of funds or a pool of professionally managed basket of securities at a relatively low cost.

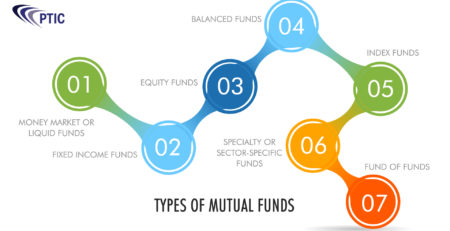

As we all know mutual fund types can range from categories such as equity funds, debt funds, diversified funds, money market funds, guilt funds, sector-specific funds, Index funds, tax-saving funds, large, mid or low cap funds, open-ended funds, close-ended funds, dividend-paying, reinvestment scheme, etc. When investing you can clearly know, understand and make a choice amongst the above mentioned. While you seek advice from your Financial Advisor and read the policy document. You would be able to spot the risk involved and see the latest trends of Net Asset Value (NAV). So you can know the performance of your mutual funds.

Defining NAV –

The Net Asset Value (NAV) of the Units determined daily by the regulations. The mutual fund NAV shall be calculated in accordance with the following formula. Or such other formula as prescribed by SEBI from time to time.

NAV = [Market/Fair Value of Scheme’s Investments + Receivables + Accrued Income + Other Assets – Accrued Expenses – Payables – Other Liabilities] / Number of Units Outstanding

*NAV computed upto four decimal places.

The NAV reflects the liquidation value of your investments by keeping a regular track of it. This can help you ascertain the performance of your product before you invest in it. By doing so you can keep a close check on market fluctuations and effects on the performance of several investment products. Mostly it is the NAV that acts as an inviting factor for most of the investors looking at various products. And at the same time, it also helps them in calculating returns and manages their monthly payments, well in advance. Clearly, NAV acts not just as a formula to know and assess your returns and risk involved. But also enables you to spot and trace mutual funds truly worthy of investments.

While many investors believe in keeping a check and track on latest NAV offered by different products, there are also a few who firmly oppose and consider this practice futile, because of the simple logic that when one invests in mutual funds, they buy units at NAV that has been calculated at current market price of the assets. Thus, it represents the intrinsic worth of the fund. Whereas, in the case of stock investing, the price of stocks usually varies from its book value. Which means stock price when compared to the book value of the company can either be higher or lower.

Irrespective of what one believes, keeping a check on the trends of NAV is always a good idea in terms of market knowledge. And though mutual fund investments have risk attached to them. But when you manage with a proper plan, it can be quite rewarding.