Health insurance in India is constantly getting modified and more user-friendly by the day. One of the factors helping this transformation is the awareness of policymakers. In order to make an informed decision about one of the most important aspects of life called health, they need to have full information and awareness. It is this knowledge that is helping the sector of health insurance grow.

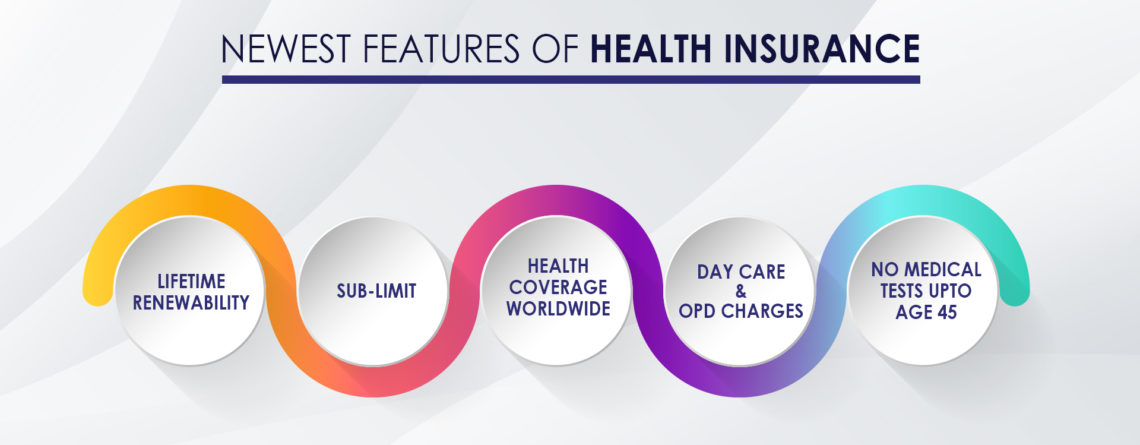

Listed below is a brief explanation of the most recent developments in the health insurance policies in India.

Lifetime Renewability

This is a recent feature added in the plan. With growing age, both premium and the difficulty to get the health coverage to widen. Previously there was an age limit set by the health insurance providers for the plan and was usually 65-70 years varying as per different policies. Now, as per the revised guidelines of the IRDAI, lifetime renewability will be offered by all the all health insurance providers. The policy plan has to be renewed until the policy holder’s lifetime, once it has been offered.

Health Coverage Worldwide

In the world where globalization has taken over, how can the sector of health insurance lack behind? With the transforming policies, it is necessary that people are able to enjoy the best health insurance benefits worldwide. Selection of international plans can help you out with the emergency health services required. It could also provide health coverage in case the purpose of your visit abroad is a better health service.

No Medical Tests up to age 45

In order to ease out the process of buying health insurance, policymakers are coming up with any medical tests for applicants’ up-to the age of 45 years. There is catch though. You will have to be ultra careful and honest while filling out the form. You will have to provide full disclosure of your health condition, failing which will result in heavy penalties in addition to policy cancellation.

Sub-Limit

One of the important factors you need to see while deciding a plan is sub-limit. Sub-limit means that different costs incurred will be reimbursed. Let us take an e.g. to understand this better. In the case of hospitalization, the total cost is the combination of room rent, surgery fee, medicine cost, equipment cost etc. In sub-limit, all of these have to be added. These are mostly applied with the option of less premium amount.

Day Care and OPD Charges

Earlier the benefits were given only if the person was hospitalized for at least a day. But recently, the policy has been modified and now, if u stay for a few hours you can still claim the health cover. Some of the treatments take up only a few hours like chemotherapy, dialysis, x-ray, eye surgery etc. And these are also these covered in the health insurance. Along with this dental care, which is neither daycare nor 24-hour hospitalization is covered as an outpatient expense.

The policies are undergoing constant change in order to provide as much comfort and benefit as possible to the user group. New features are being added for the same.