Think about your retirement, otherwise, you may get into trouble.

You should not be postponing the planning for your retirement and breakthroughs that your life can throw at you anymore.

Since you do not have any burden on yourself regarding finances and major expenses of your family, you can use your superfluous income in some investments that will eventually be useful for your family and you in making your future safe economically.

Unless or until your preferences are not typically changed, you all must use your superfluous income to save for the hardships life may throw at you. Only with the right guidance and assistance, one can actually be secured for the fulfillment of your future objectives.

Here’s how you can save and keep your money so that it may help you in difficult situations

- First of all, you should start saving in the early years of your career itself.

- If you start investing for your future at the right time, then you will many chances and benefits by which you can make strategies that can help you out appreciably. This will also lead you to enhancement in your income.

- By proper examining your expenses, you can analyze where you are spending more. This will help you in saving the extras and investing more.

- When you find an additional source of income or increment in your income anyhow, before getting in habit of this extra income, you must start investing or saving it.

- You must retain money with which you can cop up with the financial crisis for at least 3 to 6 months.

- Handle your invested money carefully.

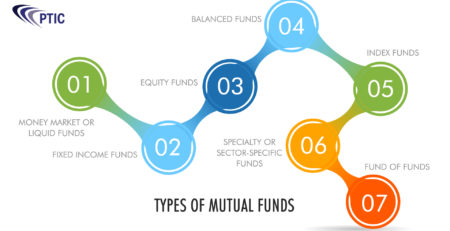

- Check how much risk you can tolerate and regulate the assets allotment for credits, funds, equity or land.

- Try to get more and more returns. This can only be done by investing your money in the right place at the right time.

- You should give your attention to tax connotations, money expenditures, etc.

- Set up your future needs and assumptions and the strategies for the fulfillment of your future goals.

- Consider the after-life of your retirement and do plan for you’re well being afterward.

- You should also consider the future house requirements.

- You should manage your investments in a way so that there would occur no problems for your family regarding finances and living expenses after your retirement.

- Make sure that your insurance covers will help you in accidental situations that may occur.

Visit us to get your retirement strategies customized. It will help you in achieving and fulfilling your daily needs.